Should you dump all your cash into Bitcoin at once—or spread it out bit by bit over time? It’s an age-old debate in investing circles: lump-sum investing (LS) versus dollar-cost averaging (DCA). With Bitcoin’s notorious volatility, the answer goes beyond mere returns. It touches risk tolerance, emotional discipline, and the messy realities of market timing.

TL;DR

- In strong bull markets, lump-sum tends to outperform simply because your money gets to work sooner.

- DCA usually smooths the ride, reducing volatility and downside exposure. That often leads to better risk-adjusted returns—even if the total profit is slightly lower.

- In downturns or sideways markets, DCA often comes out ahead by avoiding the pain of poor timing.

- Your strategy should fit your psychology—trying to squeeze an extra percent return may not be worth the stress.

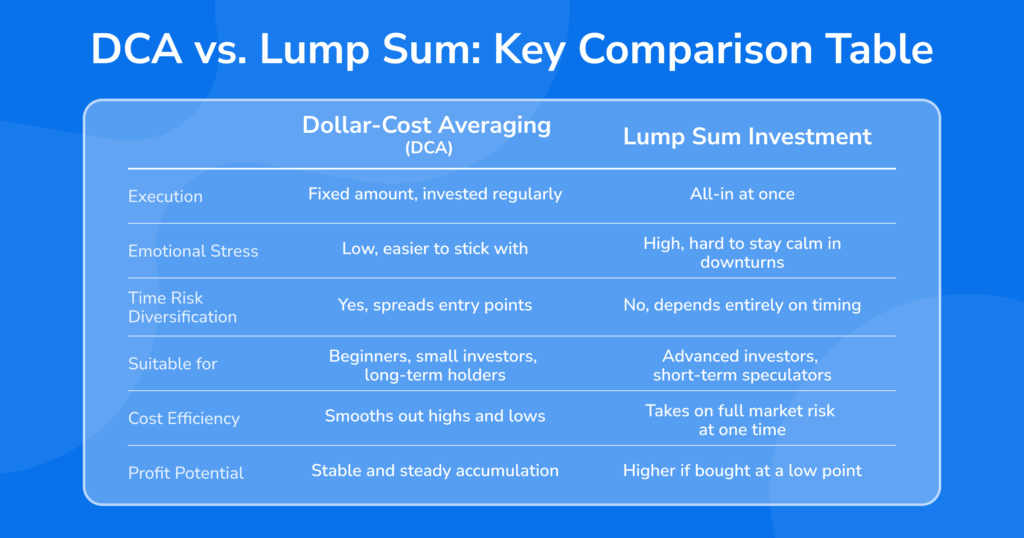

The Basics: What Are We Comparing?

- Lump-sum (LS): You invest a fixed amount AAA all at once at the starting price P0P_0P0.

- Dollar-Cost Averaging (DCA): You divide AAA into nnn chunks and invest each part periodically (weekly, monthly, etc.) across prices P1,P2,…,PnP_1, P_2, …, P_nP1,P2,…,Pn.

Metrics to evaluate:

- Final portfolio value

- Volatility across the investing period

- Max drawdown (largest drop from peak to trough)

- Risk-adjusted return (e.g., return divided by standard deviation)

Why Lump-Sum Usually Wins—On Paper

Assets with long-term upward momentum reward early exposure. If Bitcoin climbs steadily, then throwing your entire sum in on day one lets every satoshi grow. That’s why, over long periods with upward trends, lump-sum typically delivers a higher final return.

But here’s the catch: results are highly path dependent. If the market drops right after you invest, lump-sum looks terrible. If it surges, you’re a genius. Bitcoin’s history is a mix of rocket rides and faceplants—timing matters more than we like to admit.

Why DCA Might Be the Better Ride

Even if lump-sum wins on raw numbers, DCA often wins emotionally—and that’s crucial for real-world investors:

- Reduces timing anxiety: You’re not dumping all your cash in right before a crash.

- Buffers drawdowns: Your entry price floats with the market, softening early losses.

- Supports consistency: Sticking to a plan matters more than finding the perfect one. DCA keeps you in the game when fear takes over.

In other words, if you’re human—and not a perfectly rational machine—DCA can be your behavioral safety net.

Three Typical Market Scenarios (with Bitcoin)

Suppose you plan to invest $12,000 into BTC over 12 months. How might it play out?

1. Market Rises Steadily

- LS: Buys at $30k, rides the full move to $45k. Highest final value.

- DCA: Averaged entries around $37.5k. Ends slightly behind, but with smaller swings.

Verdict: LS wins on return, DCA feels smoother.

2. Market Trends Down

- LS: Buys high, watches value fall. Ouch.

- DCA: Buys cheaper over time. Lower average cost, less painful.

Verdict: DCA wins both emotionally and financially.

3. Sideways and Volatile

- LS: Could work—or flop—depending on timing.

- DCA: Capitalizes on price dips, benefits from mean reversion.

Verdict: DCA often pulls ahead thanks to volatility smoothing.

What Backtests Reveal

Backtesting over various start dates and durations shows some consistent themes:

- Lump-sum leads in strongly bullish windows—bigger gains, but also bigger risks.

- DCA delivers more consistent results, especially in high-volatility or short-term scenarios.

- Over longer horizons (3+ years), the differences narrow as long-term trends dominate.

Other Factors That Matter

- Investment horizon:

- Short-term (<1 year): Sequence of returns matters most; DCA smooths the risk.

- Long-term (3+ years): Time-in-market helps LS edge ahead.

- Market volatility:

- High volatility favors DCA.

- Low volatility bull markets favor LS.

- Fees:

- DCA can rack up transaction costs. Use monthly intervals or low-fee platforms to offset this.

- Taxes:

- DCA creates more tax lots, which can be good for loss harvesting—or a logistical pain, depending on your tax jurisdiction.

- Discipline:

- If you tend to panic during drawdowns or get stuck trying to time the market, DCA’s automation can save you from yourself.

Try It Yourself: A Simple Simulation Framework

Want to run the numbers?

- Choose a historical start date.

- Allocate capital AAA; set DCA frequency.

- Simulate:

- LS buys at P0P_0P0, holds.

- DCA buys at intervals P1,…,PnP_1, …, P_nP1,…,Pn.

- Track:

- Final portfolio value

- Max drawdown

- Volatility

- Risk-adjusted return (optional)

Repeat across many periods. You’ll likely find: LS wins more often on average, but DCA offers a smoother ride and better downside protection.

Choosing the Right Strategy (Or a Mix)

Go Lump-Sum if:

- You’ve got a long runway, high risk tolerance, and emotional stability.

- You’re ready to watch your portfolio drop without flinching.

Go DCA if:

- You want to reduce regret and remove timing from the equation.

- You’re investing ongoing income (like a paycheck).

Consider a hybrid:

- Deploy 50% now, DCA the rest over a few months. Best of both worlds.

Final Tips

- Automate your strategy to avoid second-guessing.

- Use limit orders or smart routing to reduce slippage.

- Stick to your plan—don’t pause DCA just because the market dipped.

- Monitor fees, especially on small, frequent buys.

- For large amounts, consider using layer-2 networks or centralized exchanges with L2 routes to minimize network fees.

Common Questions

What if I buy right before a crash?

Lump-sum gets hit hardest. DCA softens the blow. If this keeps you up at night, DCA (or a hybrid) is your friend.

What’s the best DCA frequency?

Monthly is a good middle ground—fewer fees, decent smoothing. Weekly adds nuance but costs more.

Can I DCA more during dips?

Yes—some use value averaging or boost purchases after drops. Just make sure your rules are clear and emotion-free.

What about altcoins?

DCA might be even better for alts. They tend to be more volatile and less predictable. Still, backtest if possible.

Bottom Line

Lump-sum investing often wins on average return—but it’s a bumpier road. DCA helps manage regret, smooths volatility, and keeps you invested when emotions run high. Over time, the difference narrows, and consistency becomes the real edge.

In the end, the best strategy isn’t the mathematically optimal one. It’s the one you’ll actually stick to.

Let me know if you’d like a PDF-formatted version or specific styling for publication or social media.