Cryptocurrencies are computerized money that doesn’t depend on governments or banks to function. They exist on public ledgers called blockchains, where transactions are stored forever and anyone can check them. To comprehend them fully, peel off three layers: the asset (bitcoin, ether, etc.), the network (blockchain), and the rules of consensus (how the network decides on the state).

1) Cryptocurrency: indigenous internet money

A crypto is a scarce digital token you can send to others without intermediaries. It’s owned using public-key cryptography:

- Private key: a secret to unlock and spend.

- Public key / address: what you provide to be given.

When one says “I own 0.1 BTC,” what they actually possess is the right to signing (using the private key) of transactions transferring the balance associated with their address.

Fast analogy: your private key is the key to your vault; your address is the obvious lock. You lose the key (seed word) and nobody can open that vault—not a bank—at least, there’s no bank.

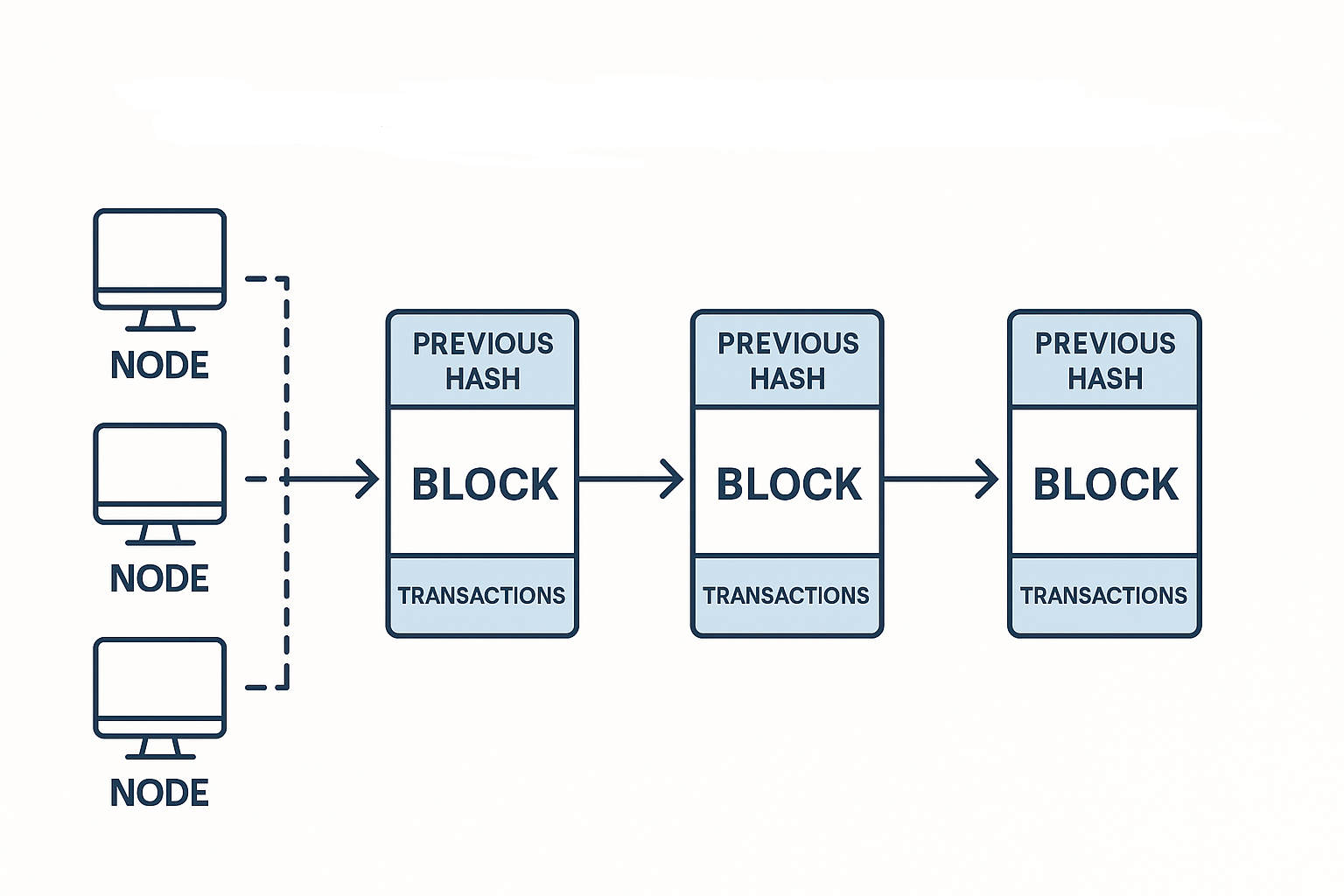

2) Blockchain: the communal accounting book

A blockchain is a decentralized ledger composed of blocks of transactions connected securely through cryptography. Each block comprises:

- A collection of legal transactions.

- A reference (hash) to the anterior block.

- Proofs needed on the part of the consensus mechanism (e.g., work in PoW or signatures in PoS).

Because the journal is duplicated on thousands of nodes all around the globe, it’s extremely difficult to modify history: in order to modify an ancient transaction you’d have to rewrite the respective block and all subsequent blocks, and persuade most of the network.

Why “chained”?

Because each block references the previous one with a hash (a unique fingerprint). Alter a single character from the earlier block and its hash alters, severing the chain. That aspect creates history immutable (or, rather, prohibitively expensive to rewrite).

3) Consensus: how the network agrees

A blockchain’s central component is its consensus mechanism, which keeps people from double-spending (paying once with twice the money) without a central authority.

- Proof of Work (PoW): Miners race each other to solve mathematical puzzles to advocate for blocks. This is Bitcoin’s framework. It provides good security in return for energy consumption.

- Proof of Stake (PoS): Validators stake coins and are probabilistically chosen to propose/validate blocks. If they are naughty, they lose a fraction of their stake (slashing). Ethereum has operated PoS from 2022. It reduces energy consumption and provides quick finality, but brings various economic and centralization risks.

Finality is how permanent a block is. In Bitcoin one typically waits for “6 confirmations”; in Ethereum PoS, economical finality is achieved after a few “epochs.”

4) Transactions step by step

- Construction: you create a transaction using your private key (e.g., “send 0.01 to address X”).

- Propagation: you announce it; nodes verify it (balance, formatting, signatures).

- Inclusion: a validator/miner puts it in a block.

- Confirmation: end of block being added to chain; additional blocks atop = reduced reorg possibility.

You’ll pay a block producer a fee. In Ethereum it’s a base fee and tip; on Bitcoin it’s normally fee/byte. In congestion fees are higher. So scaling solutions (L2 such as Bitcoin’s Lightning or Ethereum’s rollups) group transactions to reduce fees.

5) Coins vs. Tokens vs. Stablecoins

- Native coin: the chain’s primary asset (BTC on Bitcoin, ETH on Ethereum).

- Token: a coin launched on a pre-built chain (e.g., ERC-20 on Ethereum), allowing projects to go live without a new blockchain.

- Stablecoin: a coin whose price is stabilized to an outside asset (typically USD). It can be supported by reserves (USDC) or algorithmic (riskier). Applied to payments and shelter from volatility.

6) Smart contracts: programs that transfer money

In programmable networks (such as Ethereum), rules can be written in smart contracts—programs that hold assets and run when rules are triggered. From this we get:

- DeFi: decentralized exchanges (DEX), lending, on-chain derivatives.

- NFTs: ownership and transferring of special assets.

- DAOs: voting governance through tokenization.

Security is dependent on coding and audits. A single flaw can run into millions.

7) User security: must-knows

- Seed phrase (12–24 words): your master backup. Print it on metal/paper; do not keep it in photos or the cloud.

- Cold (hardware) wallets: remove the private key from your PC/phone, lowering malware/phishing exposure.

- Mindful signing: check permissions before any “approve” or “sign.” Utilize simulators and rescind stale permissions.

- Impersonation/phishing: be sure to check URLs, do not follow links from emails and “support” seeking your seed.

8) Strengths and Limits

Strengths:

- Direct ownership of assets, censorship resistant.

- Programmable compatibility: money as lego (composability in DeFi).

- Transparency: all things are on-chain auditable.

Limitations:

- User experience still choppy (self-custody, fees, permanent mistakes).

- Base-layer scaling; thus L2s and so on.

- Guaranteed and counterparty risk (for centralized services and custodial stablecoins).

9) What are they used for today?

- Savings and cross-border payments: instant remittances without banks.

- Inflation hedge in foreign nations (volatility to be taken into account).

- DeFi/NFTs/games: emerging markets and business.

- Infrastructure of the Web3: identity, micro-incentives, governance.

10) FAQs

Can I «copy» a coin?

No. You can copy a wallet file but without the existing private key you couldn’t send funds. The communal ledger stops double-spending.

What if I forget my seed phrase?

There is no customer support to recover it. You lose both the device and the seed, and you lose access. This is why physical backups—and for high amounts, multisig—are necessary.

Why are crypto prices so volatile?

24/7 worldwide crypto trading with high speculation and sensitivity to liquidity, narrative, and regulation. Stablecoins purport to mitigate volatility—but do so at a price.

In a sentence

A cryptocurrency is sovereign digital currency, and the blockchain is the open bookkeeping ledger that makes it function—using cryptography and consensus to allow anyone to own and transfer value without seeking permission.

Your next read: “Wallets: Hot vs. Cold — How to Choose and Set Up” with a starter security checklist.