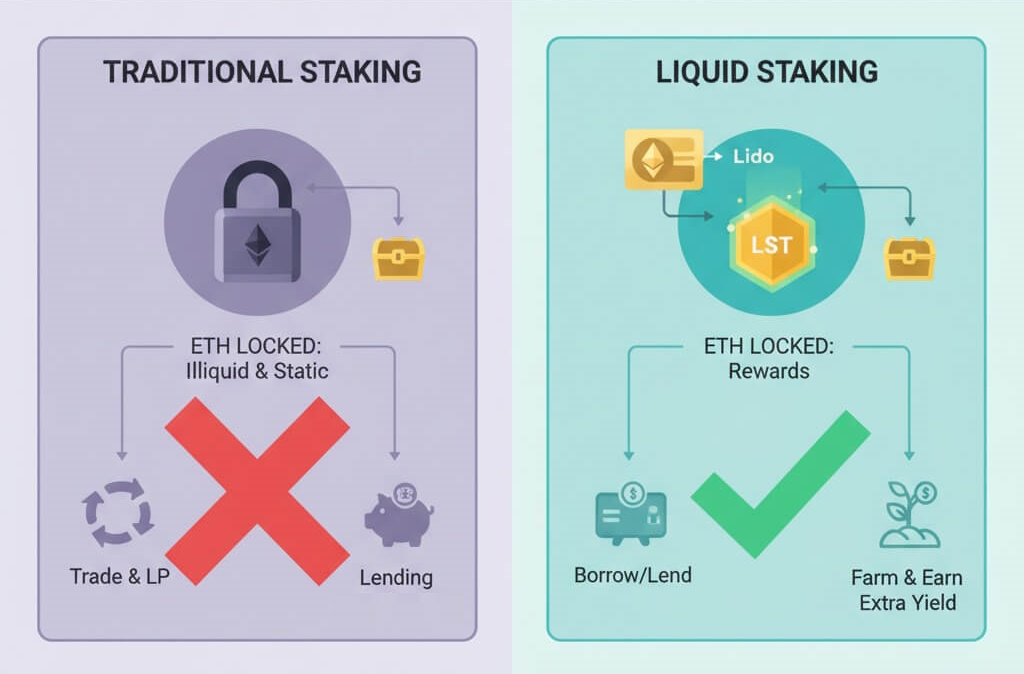

Staking makes your cryptocurrency useful by locking it up to help secure a Proof-of-Stake (PoS) network and earn rewards. You can stake in two main ways today: native staking (directly on the base chain, usually through a validator) and liquid staking (depositing to a protocol that issues a Liquid Staking Token, LST, which you can trade or use in DeFi). This guide explains how each one works, what you gain, and what you risk so you can choose the one that best fits your goals.

TL;DR

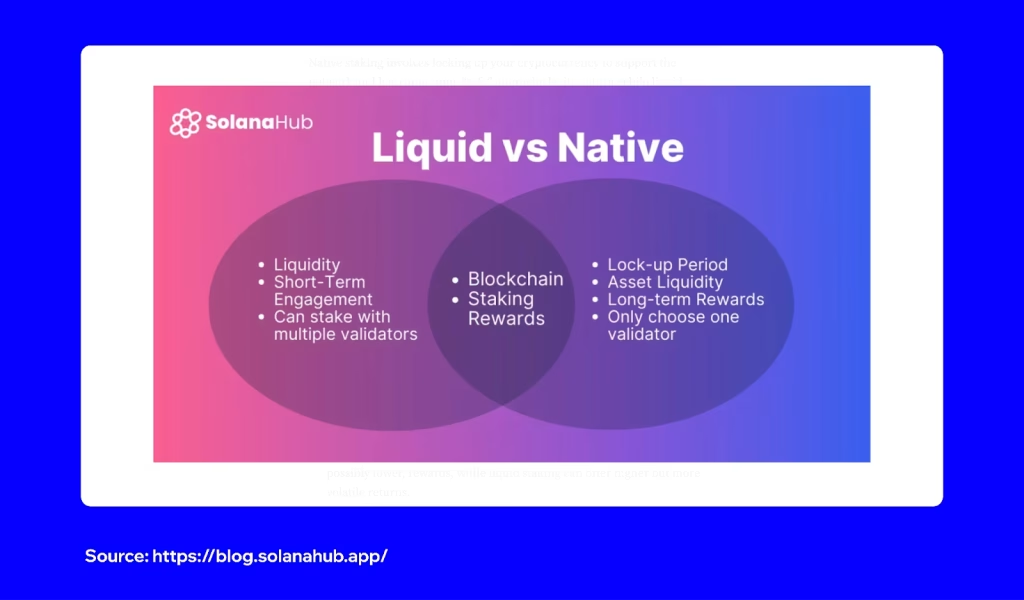

- Native staking: This is the easiest trust model (at the protocol level) and is very in line with network security, but your money is locked/illiquid and it takes a little more work to set up.

- Liquid staking (LST): You get a receipt token (like stETH, rETH, or cbETH) that shows where you staked and can be traded or used in DeFi. You get more flexibility and maybe even more yield, but you also take on risks like smart contracts, custodial/concentration, and pegging.

- For people who want to hold on to their investments for a long time and don’t want to take on too much extra risk, native wins. If you size conservatively, LST is interesting for active DeFi users who want liquidity and composability.

What is staking in its natural state?

You either delegate or run a validator directly on the base chain. Rewards build up at the protocol level and can usually be claimed or auto-compounded on-chain. For example:

- Ethereum: You can run a validator (32 ETH) or delegate through a native pool/operator. Withdrawals happen through protocol exits and can take a while.

- Cosmos chains: delegate to a validator; rewards build up block by block; unbonding has a «cooldown» period that depends on the chain (for example, 14 to 21 days).

- Solana: Give SOL to validators; withdrawals depend on the timing of the epoch.

Characteristics of native staking

- Security surface: only the protocol and your validator/delegation—no extra smart contracts by default.

- Liquidity: limited; you have to wait for the unbonding/exit period to get your principal back.

- Risk of slashing: If your validator does something wrong (like double-signing or going down), your stake could go down. Choosing a trustworthy validator helps with this.

- Yield: the base staking APR (which changes depending on the network, the number of people who participate, and the fees). You can’t get stacked DeFi yield unless you rehypothecate somewhere else (which is usually not possible during lock).

What is LST, or liquid staking?

You put assets that can be staked into a liquid staking protocol. The protocol stakes for you and gives you a LST, which is a tokenized claim on your staked position and rewards. Some examples are stETH, rETH, cbETH, sfrxETH, stATOM, stSOL, and so on. You can trade LSTs, use them as collateral, or farm more yield in DeFi while still getting staking rewards in the background.

LST features

- Liquidity: You can sell the LST at any time (as long as the market is deep enough) or redeem it through protocol flows (which may take a while).

- Composability: LSTs can be used with DEXes, money markets, leverage protocols, and structured products.

- Other risks: bugs in smart contracts, problems with oracle/derivative pricing, peg deviations (when the price of LST is lower than the value of the underlying), operator concentration, and governance risk.

- Yield: staking APR plus possible DeFi yield—but with more risk.

A comparison of two things

| Dimension | Native Staking | Liquid Staking (LST) |

|---|---|---|

| Model of Trust | Protocol + validator | Protocol + validator(s) + protocol contracts/governance |

| Liquidity | Locked; wait exit/unbond period | Token that can be traded; secondary markets; sometimes instant liquidity |

| Yield | Base staking APR | Base APR + possible DeFi yield |

| Risk surface | Slashing, validator ops | Slashing + smart-contract, peg, oracle, governance, liquidity |

| Complexity | Lower once set up | Higher (more moving parts, strategy choices) |

| Fees | Validator/commission | Validator + protocol fee + DeFi fees |

| Censorship/centralization | Changes depending on the validator set | Risk of «operator concentration» through large LST providers |

| Tax angle (changes depending on the jurisdiction) | — | Rewards at receipt; LST trades add taxable events |

The good and bad in real life

Native staking: Pros

- Low extra risk: there are no extra smart contracts, so your risk is mostly at the protocol level.

- Clean alignment with security: helps the base chain become more decentralized.

- Clear reward path: fewer middlemen and easier bookkeeping.

Native staking: Drawbacks

- Illiquidity: your money is tied up, and you miss out on opportunities if you want to trade or change your mind.

- Operational friction: choosing and rotating validators, managing exits, and dealing with slashing insurance (if there is any).

- Lower total yield ceiling: you only get staking APR.

Benefits of Liquid Staking

- Liquidity and flexibility: You can rebalance or get out by selling the LST; you can also use it as collateral.

- DeFi composability: stack yields (for example, by giving LST to a money market or farming incentives).

- Accessibility: lower minimums and one-click UX on many chains.

Liquid staking: The Bad

- Peg risk: When things get tough, LST may trade for less than the value of the underlying asset (discount), especially if redemptions are slow or unclear.

- Smart-contract & governance risk: Bugs, exploits, or controversial upgrades can lower value.

- Concentration externalities: When big LST providers accumulate stake share, it can make validators less diverse and invite policy and regulatory pressure.

- Complex P&L: Multiple legs (staking rewards + DeFi strategy + LST price drift) make accounting and taxes more difficult.

When to choose which

If you want to use native staking,

- Are a «long-term holder» who cares about base yield and security contribution. Don’t need a lot of liquidity and would rather have a lower-risk surface. Want accounting to be easier and the rules to be clearer.

If you want to, pick LST.

- You actively use DeFi and want to use your staked capital as collateral.

- Value liquidity so you can change positions without having to wait for exit periods.

- Are at ease with figuring out protocol risk, peg liquidity, and counterparty dispersion.

Hybrid approach: stake a «core» allocation natively and a «smaller» slice through diversified LSTs (multiple providers/chains) to limit the risk of a single protocol.

How to manage risk for LST users

- Use different providers and operators: Don’t put all your money into one protocol; check how many validators there are and what their policy is on slashing.

- Keep an eye on the peg: keep an eye on the LST price compared to its «theoretical value» (for example, the underlying value plus any rewards that have been earned). Deep discounts can mean that people are having trouble getting their money back or that they don’t have enough cash.

- Choose protocols that have been audited and tested in battle: look for time in the market, bug bounties, outside monitoring, and open governance.

- Be careful with rehypothecation ladders: LST → lending → leverage can make drawdowns worse. Keep your size small and use health-factor alerts.

- «Exit realism» means knowing about redemption queues, cooldowns, and conditions like oracle dependencies and rate limits. When things get tough, selling on secondary markets may be faster, but you’ll get less money.

List of things to do

- Fees: look at the protocol cut, validator commission, and gas.

- Redemption path: how long does it take to get the base asset back? Is the instant liquidity provided by AMMs deep enough for your needs?

- Accounting: Keep track of your staking rewards, LST basis, and any DeFi yield separately.

- Security posture: hardware wallet, limited approvals, and periodic allowance revokes.

- Governance risk: read forums and votes; be aware of how fees, operators, and safety modules can change.

Questions and Answers

Can an LST «depeg» for good? Yes, if redemptions are affected or trust is lost. Protocols that are well-designed and have strong backing and guarantees for redemption tend to mean-revert, but this isn’t always the case.

Do I still get staking rewards with an LST? Yes. Depending on the design, the LST usually either rebases (the balance goes up) or accrues value (the price goes up compared to the base) to show rewards.

What about slashing? At the validator layer, both native and LST positions can be slashed. Some LSTs come with safety or insurance modules, but you should read the fine print.

Is restaking the same thing as liquid staking? No. Restaking uses staked assets again to get more services (more yield, more risk). You can restake natively or through LSTs, which adds to the risk.

——

The bottom line

- Native staking is less complicated, has a strong alignment, and is illiquid.

- Liquid staking means «liquid and composable,» but it also adds «contract/peg/governance» risks.

Choose based on what you really need: If you’ve been compounding quietly for years, native is hard to beat. But if you need to build strategies or move collateral around, LSTs give you powerful options that work best when you diversify, monitor your peg, and keep a close eye on your risk.